The following is an abridgement of chapter 4 in the recently published book Financial Sovereignty for Canadians (March 2024), authored by Fergus Hodgson. It is published here with the author’s kind permission.

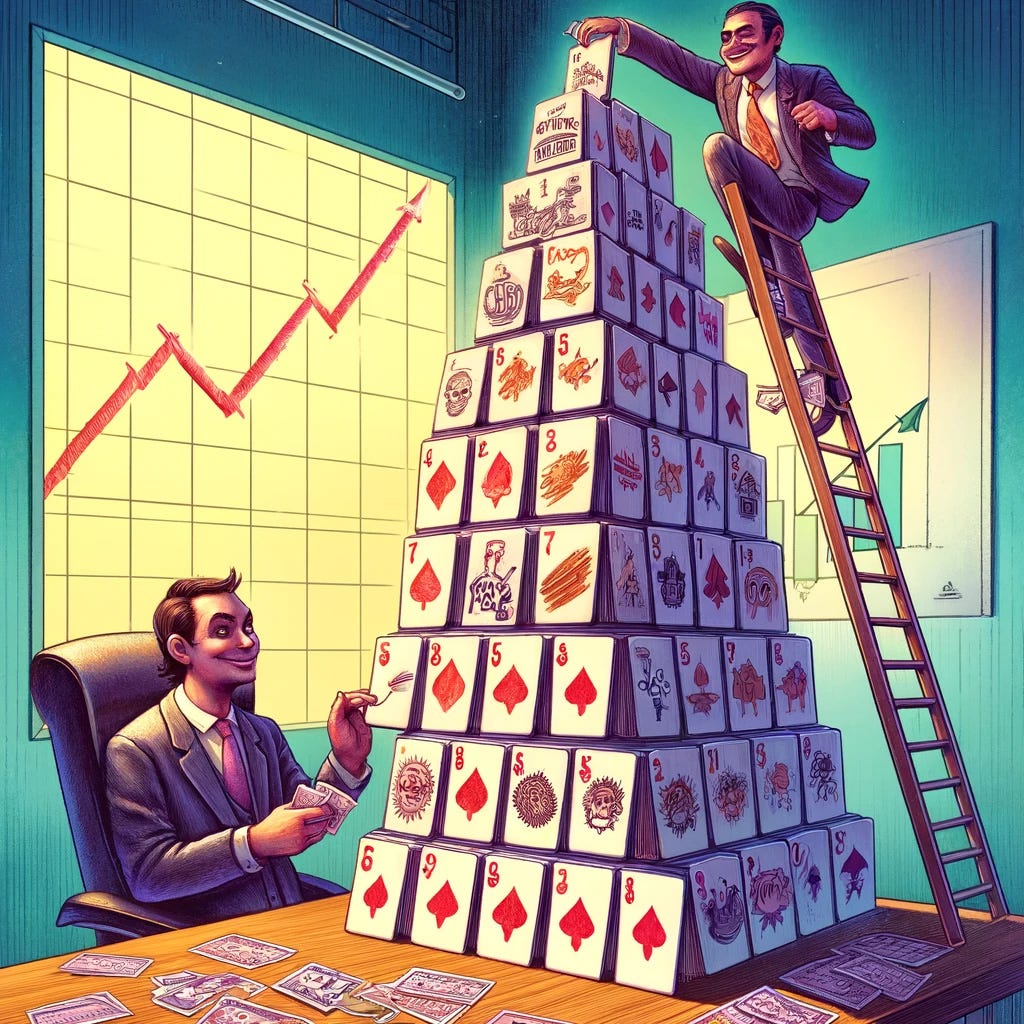

There is a silver lining to Alberta Premier Danielle Smith’s pursuit of a provincial pension system. Alberta’s potential departure from the Canada Pension Plan (CPP), which already excludes Quebec, is highlighting that the CPP is a pay-as-you-go Ponzi scheme.

As noted by the Chartered Alternative Investment Analyst Association, “A Ponzi scheme requires the continual recruiting of new investors to sustain the fund.” CPP recipients depend chiefly on fresh taxes taken from newcomers and not on investment returns. Private Ponzi schemes rely on fraud; the CPP relies on coercion and sleight of hand.

Prime Minister Justin Trudeau claims an Alberta Pension Plan (APP) would cause “undeniable” harm. He will do “everything possible to ensure [the] CPP remains intact,” unfoundedly suggesting that the payments will not. He fears more competition and accountability, and less wealth redistribution and social engineering from Ottawa.

An Alberta provincial alternative would also illuminate that Albertans would pay 40 percent less to an APP while remaining CPP participants would pay 5 percent more. As Tegan Hill wrote in the Calgary Sun, “the idea of a provincial pension plan grew from the frustration of Albertans, but with tangible benefits … it could actually become a reality.”

Faux Sustainability

CPP Investments touts the plan’s sustainability, but that is misleading. The CPP has dug a hole with an unfunded liability—the present value of promises over assets—of at least $1.14 trillion. According to numbers from the 31st Actuarial Report, the CPP is 68 percent unfunded.

Without coerced newcomers and mandatory participation, the CPP could not meet its obligations and would be bereft of assets within a decade. However, newcomers dig the hole deeper because, as they pay in, they generate more unfunded liabilities. That is why immigration—even if it helps the CPP limp on—fails to address the structural problem.

And the problem is substantial: the unfunded liability is more than a trillion dollars. Chief Actuary Assia Billig has used an accounting trick in his calculations for December 2021, and his politicized report hides the official estimate as a footnote.

The problematic unfunded-liability calculation stems from the discount rate. Another footnote states the present values are calculated using the “assumed overall rate of return on base CPP assets,” and the “rate of return assumption” is 5.79 percent. This conflates numbers that do not belong together. Risk-free future payments need to be discounted at a risk-free rate—not at an assumed portfolio return—for an accurate present value.

Discount rates are game-changers over extended periods. Assume you are 50 years old and will retire in 20 years. You will receive a $500,000 annuity paying $40,000. What is that worth now? Discounted at 5.79 percent, its present value would be $162,210.

However, an appropriate discount rate would be 2–3 percent for a riskless annuity, consistent with Government of Canada bond yields. Discounting the $500,000 at 2.5 percent over 20 years gives a present value of $305,135, double the previous estimate.

The CPP’s unfunded liability is likely well north of $2 trillion, given time horizons longer than 20 years. The corrected figure exceeds $50,000 per capita, dwarfing the $1.2 trillion national debt. If younger generations understood the unfunded liability, they would want to opt-out immediately.

CPP proponents often pooh-pooh concerns about unfunded liabilities, but sometimes the truth is politically salient. In 2020, then Premier Jason Kenney proposed withdrawing Alberta from the CPP. The Alberta NDP immediately disseminated the “grave financial risk” to the province of having to accept $133.1 billion in unfunded liabilities—its alleged share.

CPP sustainability rests not on financials but on an influential political lobby. Many who have paid taxes earmarked for a pension scheme feel entitled to receive payments in their old age, even if the money has already been spent. They will lobby to ensure they do, regardless of the burden to younger taxpayers.

Rising awareness of the CPP’s negligence means the program is on the verge of crumbling. Even the CBC has reported that Alberta’s departure could “increase incentives for British Columbia and Ontario also to leave the CPP—and to do it quickly.”

Prepare Yourself

Canadians would be wise to anticipate: (1) higher CPP taxes; (2) reduced CPP benefits via older retirement ages; and (3) a fragmentation into provincial programs.

A superior approach would be for new entrants to participate on a defined contribution basis. The participant receives what he contributes plus its returns—no more or less. The payments would not be set in stone, but there would be no new unfunded liabilities or discount-rate chicanery.

Even in corporate settings, defined-benefit plans are shaky. Add electoral politics, and you get a downward spiral of vote buying charged to future taxpayers. Workers now pay more than three times the rate at the CPP’s genesis in 1966, which was 3.6 percent of an earnings band. In 2023, the rate was 11.9 percent, and from 2024 an additional income band for CPP taxes will come into force, doubling in 2025.

Monopoly Service

Informed proponents support the CPP being a redistributive welfare program with Ponzi attributes rather than a pension scheme. Ideological affinities lead them to turn a blind eye to poor financial performance.

Since the lion’s share of CPP taxes is transfers, real CPP returns have dwindled with each decade, now down to a paltry 2 percent. Press releases from CPP Investments parade a high rate of return on invested assets: an annualized 10.9 percent, but that is not what participants receive. CPP Investments simply cannot deliver that performance to participants so long as most CPP taxes pay recipients and do not get invested.

Papered-over mediocrity is typical of public pension plans since they hold a monopoly and need not compete. Public pension plans have been embarrassingly late to alternative asset classes such as venture capital, decades behind endowments and corporate pension plans.

Rather than focusing exclusively on returns, the CPP has eagerly adopted the false god of ESG (environmental, social, and governance) factors. As Ian Madsen of the Frontier Centre for Public Policy warns, “Green virtue-signalling ESG funds are a path to smaller pensions.”

The CPP is an eyesore in the way of Canada’s competitiveness. People with the flexibility to avoid it are few and far between. Aside from brief, informal workers and those employed by foreign governments, exempt individuals tend to be Canadians who identify as First Nation.

You can leave Canada altogether, and whatever payments you have accumulated can follow you abroad. Those working in the United States, however, still fork out for Social Security.

The Generational Storm

Two decades ago, one of my college instructors foresaw a younger generation hobbled with obligations to retiring baby boomers. That storm has arrived in Canada.

One justification for an expanded CPP was that Canadians did not save enough for retirement. However, every additional dollar that they have allocated into CPP is a dollar they have removed from private investments such as registered retirement saving plans.

In 1997, the International Monetary Fund warned of the CPP’s “adverse effects on output and capital formation.” The CPP rests on “intergenerational redistribution and distortionary taxes [and is reducing] aggregate savings and labour supply.… Either the baby-boom generation will face much lower retirement benefits than its parents did, or its children will pay sharply higher taxes.”

The latter has already happened. The best Canadians can hope for now is that provinces will opt out and offer superior management. Provincial competition would be better than Ottawa’s callous and economically deleterious approach.

Fergus Hodgson is director of Econ Americas, a financial consultancy, and publisher of the Impunity Observer, a geopolitical intelligence service.

Share Your Thoughts